Fargo Real Estate Market Analysis

Should you buy a house in Fargo, ND? In this article, we’re going to give you a Fargo real estate market analysis — because that’s where we do most of our business.

In order to understand the local real estate market, though, you need to understand some larger factors affecting the national real estate market. The biggest factor? Interest rates.

The National Real Estate Market in 2021-2022

Time and time again, newscasters keep saying that “interest rates are at an all time low.” If you’re just becoming interested in real estate, you might have no idea what that actually means. Well, we’ll give you a quick explanation: Not many people can afford to buy a house in cash, so they raise a little bit of money (usually 20% of the asking price of the house, known as a down payment). Then they get a loan from the bank to cover the remaining amount.

Since the bank unfortunately doesn’t give money away for free, they charge interest on that loan (typically anywhere from 3.5-8%). Thanks to some manipulation by the federal government to encourage economic activity, those interest rates are historically low.

According to Freddie Mac, one of the US’s largest federally-backed mortgage companies, the average 30-year fixed-rate mortgage is at 2.81%. Compare that to a few years ago, in 2018, when interest rates were at 4% (or 2007-2008, when they were at 6%).

Naturally, the national real estate market is on fire. Everyone is rushing to buy a house or to refinance their current mortgage to take advantage of today’s interest rates, because those interest rates make houses way cheaper over the course of paying down your mortgage.

And if you’re interested in selling, now is arguably the best time in modern history, with many real estate experts saying it’s probably never going to get much better than it is now. Buyers are flooding the market. Since there’s so much demand and a limited supply, prices skyrocket. That means more money in your pocket.

Why the Real Estate Market is on Fire: Buying in 2018 versus Buying in 2021

To give you an idea of how much cheaper houses cost because of low interest rates, let’s crunch the numbers on buying a $250k house in 2008 (with a 30-year fixed rate mortgage at 4%, and today, with a 30-year fixed rate mortgage at 2.8%):

In 2008, your monthly mortgage payment would work out to $1194/month. Your mortgage, in total, would cost $429,674.

Today, in 2021, your monthly mortgage payment would be only $1027/month ($150 cheaper, every month!). Your mortgage, in total, would cost $369,805 (about $60k less!).

In summary, the real estate market is hot right now because houses are cheap — and houses are cheap because interest rates are low.

Location, Location, Location: Fargo, North Dakota Real Estate Market Analysis

With that said, the three biggest rules of real estate are still “location, location, location.”

If you buy a house in an awful zip code, it doesn’t matter how low interest rates are. You might never find a buyer for that property. If there isn’t any demand, the price is effectively zero.

Luckily, Fargo, ND has experienced significant growth over the past few years — and for good reason.

First off, Forbes has ranked Fargo, ND as one of the best places to retire 10 years in a row. One of their main points is the currently low barrier to entry into the real estate market: “Its median home price of $228,000 is 20% below the national median, and Fargo real estate is a safe investment with the population growing at a steady rate of about 4 percent per year, nearing 125,000 at last count.”

Furthermore, Fargo has an unemployment rate that’s roughly half of the national average.

Its biggest sectors are education and healthcare, and the median wage exceeds the national average as well, at roughly $41k.

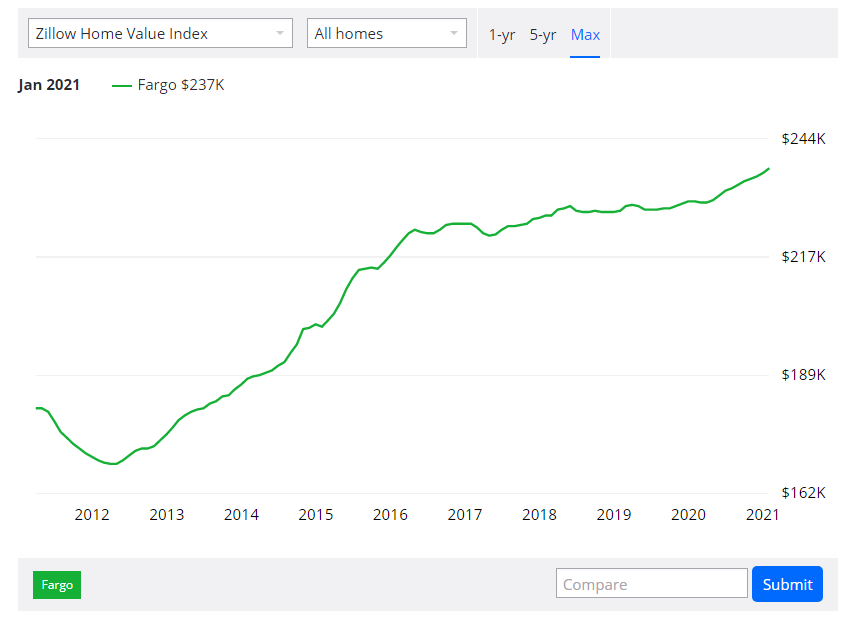

With a higher-than-average median wage, thriving businesses, steady population growth, and a lower-than-average median home price, it’s no wonder that Fargo home values have grown from $170k in 2012 to $240k today.

And, since that’s still such a low figure for what Fargo has to offer, there’s reason to believe it will continue to grow as time goes on.

Conclusion: Buy or Sell in Fargo, ND? Fargo, ND Real Estate Market Analysis

We don’t have a crystal ball, so there’s no telling what will happen to the economy nationally or locally, but you could make an argument for either selling or buying in Fargo.

First off, with interest rates at such low rates, there are a lot of buyers flooding the market, driving real estate prices ever higher. If you have any interest in selling, now might be the best time, if you want the most money possible.

On the other end of that spectrum, Fargo real estate will likely continue to grow, regardless of national real estate trends. It has stable employment, stable growth, and lower-than-average real estate prices. Since you can take advantage of all-time-low interest rates, you can get in even cheaper.

Whatever you decide, we think Fargo is a great place to invest in real estate. If you’re interested in buying or selling a house in the area, particularly distressed properties that need a little fixing up, contact us here.